CASE STUDY

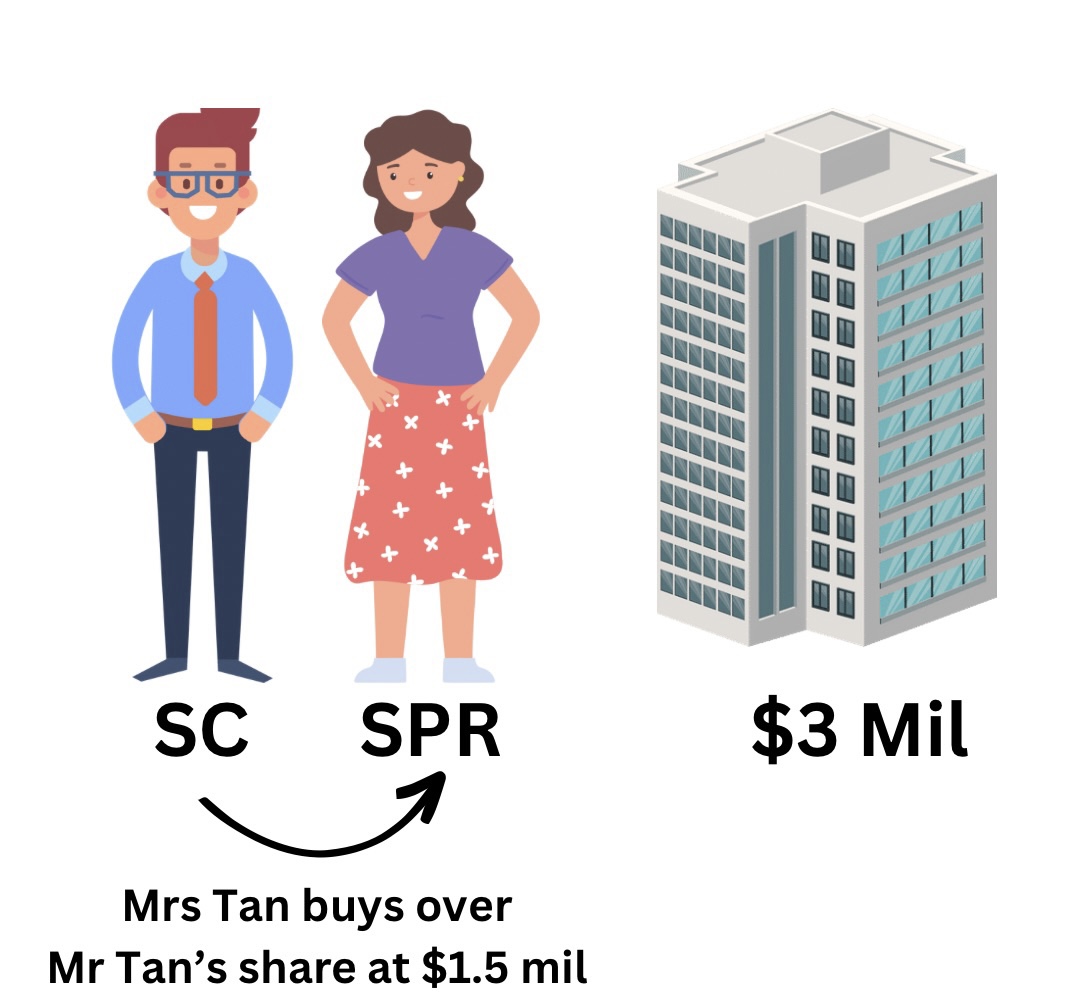

Mr Tan - Singaporean &

Mrs Tan - Singapore Permanent Resident.

They currently own a Condo valued at $3 Mil under Joint-Tenancy.

Mr Tan wants to 'decouple' by removing his name from the Condo.

He intends to buy a Studio Apartment (SA) valued at $880,000.

Consideration 1 : Is CPF used in Purchase of $3M Condo?

a) Compute CPF to be Refunded

b) CPF Usable for Next Purchase

Consideration 2 :

Any Outstanding Mortagage

Insolvency, Restructuring and Dissolution Act 2018

Where an individual becomes bankrupt within 3 years after an undervalue transfer including gift of the property to another person, this transfer is void.

Where an individual becomes bankrupt within 2 years after given an unfair preference in transferring the property to a person who is an associate of the individual, this transfer is void.

Consideration 3 : Stamp Duty Computations

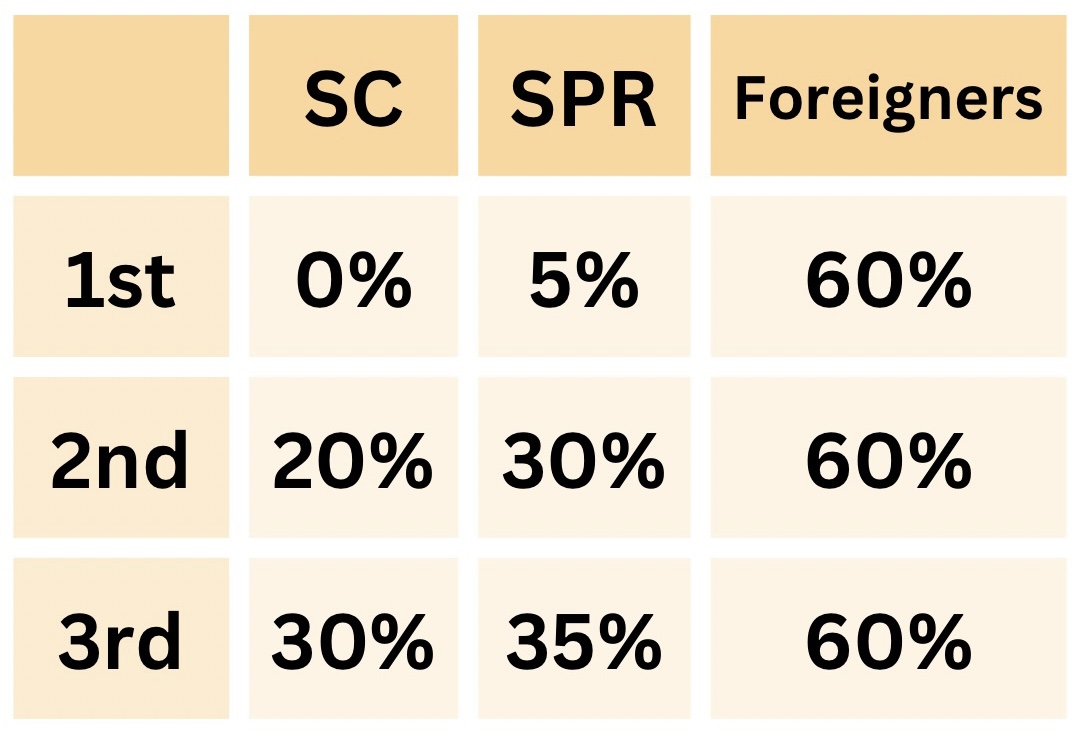

ABSD Rates on the higher of the Purchase price or Market value

If a property is jointly purchased by buyers of different profiles, the profile with the highest ABSD rate will apply on the entire value purchased regardless of whether the property is jointly owned under joint tenancy or tenancy-in-common.

Assume Mrs Tan (SPR) Buys over Mr Tan Share of Condo

1. Initial Client Assessment:

- Client assesses the need for a fresh loan and checks if the remaining owner can take the loan.

2. Existing Loan Evaluation:

- Client checks existing loan for any lock-in period/reset date to avoid penalties.

- Decoupling with bank loan may take up to about 3 months for completion.

3. Indicative Valuation of New Loan by Bank:

- New loan bank provides indicative valuation; in some cases, Letter of Offer (LO) may not be provided at this stage.

4. Document Preparation by Law Firm:

- Law Firm prepares necessary documents for the fresh loan and redemption of existing loan.

5. Signing of Sales and Purchase Agreement (SPA):

- Parties involved sign the SPA

- Remaining Owner to pay

-

- 5% (cash)

- Buyer Stamp Duty

- Additional Buyer Stamp Duty (if required)

- Client uses SPA to secure the issuance of the fresh loan Letter of Offer.

- Once SPA for Decoupling is signed, the outgoing party can exercise the option to purchase for the new purchase of property without incurring ABSD.

6. Notice to Existing Bank:

- 2 to 3 months' notice is served to the existing bank to redeem the loan.

7. Work Towards Completion:

- Parties start working towards the completion of the fresh loan and redemption process.

- Law firm representing Remaining Owner will apply for CPF / apply to the bank to disburse the monies for Remaining Owner to pay Outgoing Owner upon the completion of the decoupling transaction.

8. Completion Date:

- Fresh loan and redemption process are completed on this date.

- Payment by Remaining Owner to Outgoing Owner can be by

-

- Cash and/or

- Loan and/or

- CPF

9. CPF Refund and Ready for Use:

- 3 to 4 weeks after completion, vendor's CPF refund is transferred back to OA and is ready for use.

- If CPF funds is required from existing decoupled property for new purchase, Completion of decoupling must be 3 to 4 weeks done before the completion of New Purchase.

10. Estimated Legal Costs : $6,000 onwards.

The above serve only as a general guide and not advisory.

Please consult lawyers to ensure that all legal aspects of Decoupling are handled appropriately.